The Top 3 Reasons Why Property Managers Are Converting Parking Garage Lighting to LED

July 16, 2019

Efficient Power Tech Teams Up with Verdigris to Offer Artificial Intelligence-Based Smart Energy Management Solutions

July 26, 20195 Reasons Why Your Organization Should Fund Its Energy Efficiency Project Through Your Energy Bill

What is On-Bill Project Funding?

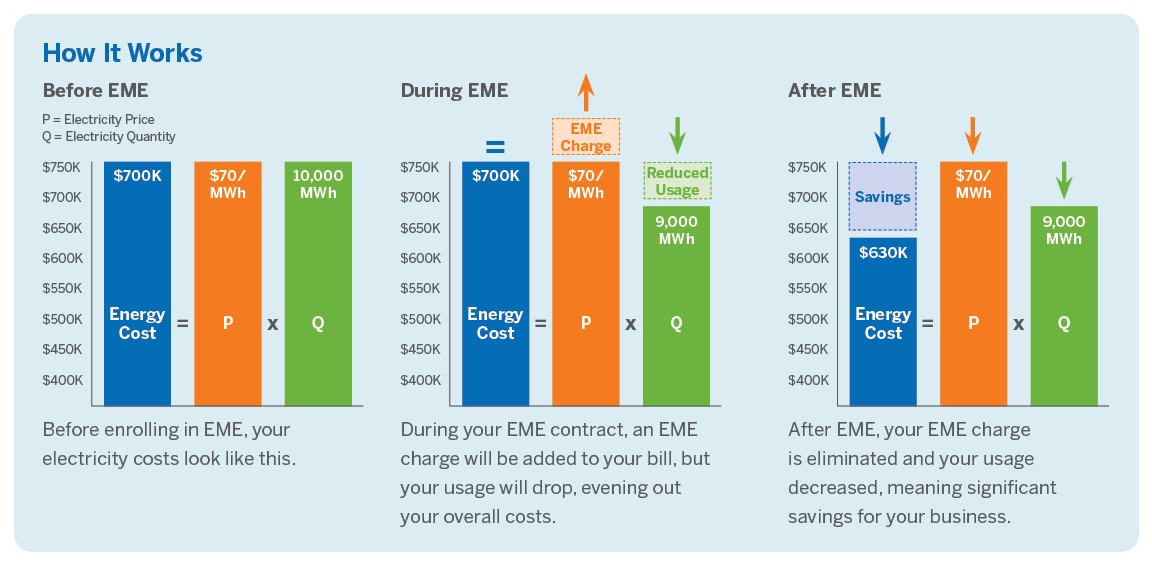

This unique project funding option allows our clients to receive upfront funding for their energy efficiency projects and allows them to pay for the cost of their projects as a line-item on their monthly energy bill over the term of their electricity or natural gas supply agreement, typically 36-to-60 months.

Below are five reasons why organizations are seeking on-bill funding options:

1.) From CAPEX to OPEX

Many of our clients say the same thing, “We have to do this…the savings this project would generate makes this a no-brainer. Now, how am I going to pay for it?”

The on-bill project funding option allows our clients to convert what would have been a potentially large capital expenditure into a manageable and predictable operational expenditure.

2.) Positive Cash Flow: The Winning Formula

Energy $avings > Monthly Payments = Positive Cash Flow

In most examples, the amount of money saved by integrating our energy efficient products is greater than the monthly payments that are required to pay for the project itself. By choosing to fund energy efficiency upgrades through their energy bill, our clients are able to convert what would have been a large upfront cash investment into a payment option that can actually generate positive cash flow instead of waiting for a standard ROI.

3.) Not A Loan Or A Lease

The on-bill project option that we offer is not a typical loan or lease. Rather, is is funding that is supplied by our partner, Constellation Energy, and does not have to be classified on your balance sheet as debt. Therefore, this option frees up your organization’s credit limit for uses elsewhere.

4.) Early Termination Fees are a Thing of the Past

Just because you’re currently locked into an agreement with another energy supply company doesn’t mean that you don’t qualify for this project!

You have two great options:

1.) . Enter into a new energy supply agreement that begins when your current agreement ends and delay project funding payments until that date (up to 36 months).

This option allows you to install your energy efficient upgrades as early as next week and not make a single payment on the equipment until your current energy supply agreement expires.

2.) Enter into a new energy supply agreement that begins when your current agreement ends and start project funding payments next month.

This option allows you to incur a lower cost of capital, compared to delaying payments, while also obtaining the energy savings generated by your project right away.

5.) Allows Your Organization to Use Its Capital Elsewhere

Every commercial real estate property or facility has a roof that’s leaking, a HVAC unit that needs a new belt, a pipe that’s leaking, a parking lot that needs to be paved or a machine that needs a new motor. We understand that these projects take immediate precedent over projects that can be classified as “upgrades.”

The on-bill project funding option provides your organization with an opportunity to free up on-hand capital so you can have your cake and eat it too. In some cases, its even possible to bundle the cost of your other projects with the cost of your energy efficiency upgrades and fund both projects through your energy bill.

Why Would your organization prefer obtaining Energy Efficiency Upgrades through OPEX Instead of CAPEX?

Often, financing departments prefer OPEX because it reduces the company’s owed income tax. In addition, OPEX is often more easily approved where as CAPEX projects are required to go through multiple managerial levels for approval. Also, the pay-as-you-go model that OPEX provides is often preferred compared to the upfront cost of CAPEX projects. Lastly, funding your project as an operational expenditure allows your organization to gain the needed benefits of an energy efficiency upgrade in a proportionate scale to your grow.

Does My Organization Qualify for the On-Bill Project Funding Option?

Not all organizations qualify for this option. To find out if your organization is eligible for this attractive offer, please give us a call at: (713) 783-2367